Forex Risk Management

Stop loss | guaranteed stop loss | forex leverage | forex margin | forex risk calculator | forex profit calculator | The exchange risk arises when there is a risk of an unfavourable change in exchange rate between the domestic currency and the denominated currency before the date when the.

Forex risk management how to calculate the correct lot

Although this is especially relevant for people new to forex trading, it encompasses disciplines that are equally important to seasoned.

Forex risk management. For example, if you were traveling from the u.s. Forex management involves the whole gamut of financial operations relating to the international activities of business organisations or firms. Forex smart money management :

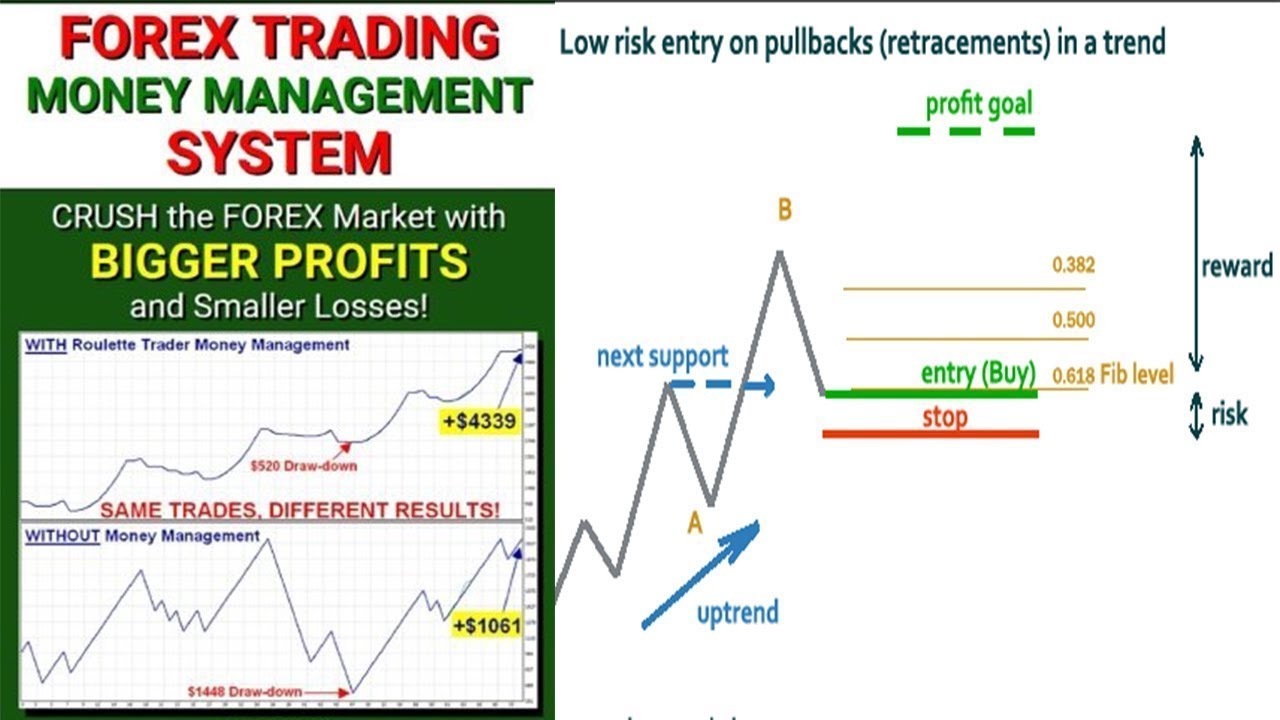

You can have the best trading system in the world, but without a solid risk management plan, you could lose everything. If you learn how to control your losses, you will have a chance at being profitable. On the one hand, traders want to keep any potential losses as small as possible, but, on the other hand, traders also want to squeeze as much potential profit as they can out of each trade.

Essentially, this is how risk management works. This strategy states that between 1% and 3% of the trading account balance may be put into harm’s way on a single trade. Therefore, understanding and managing forex risks become a priority.

An effective strategy requires proper planning from the outset, since it’s better to have a risk management plan in place before you actually start trading. Bentuk risiko yang sering dihadapi oleh para pebisnis adalah kerugian. Exchange rate risk forex traders use one country’s currency to purchase the currency of another country.

Forex risk management comprises individual actions that allow traders to protect against the downside of a trade. Trading is the exchange of goods or services between two or more parties. And so, risk management is the meticulous process of mitigating the potential losses by reducing the exposure in each trade.

Any trading strategy, no matter how profitable, is subject to money management. You likely do this when you take an international vacation. The dailyfx study reveals something very interesting about forex trading, which is that while most trades are successful (since most traders at least know something about how forex trading is done), that most traders still end up losing money over the course of their career.

Expansion into foreign countries, investing in another country, sourcing inputs from another country or selling the. Ill t i • if it is possible to forecast exchange rates if it is possible to forecast exchange rates accurately, fx risk can be controlled. It’s pretty common for new forex traders to think making money through online forex trading is fast and easy.

In fact, its profitability comes from proper forex risk management. Risk management is the key element of forex trading. Any trade has a stop loss.

Learn to control risks in trade. Forex risk management is one of the most, if not the most, important topics when it comes to trading. In this article, you will get an insight into the top risk management strategies that will help you make profits and avoid a loss to have a good experience while trading forex.

To canada, $1 usd would get you $1.31 cad. Forex risk management is the cornerstone of trading the currency market. In forex, the risk is the potential loss a trader is susceptible to incur in a particular trade.

• if international parity conditions hold, fx risk will not arise. Here is a compilation of few exam questions on forex management. Think of it for a sec.

By definition, risk management is the identification, analysis, assessment, control, and avoidance, minimization, or elimination of unacceptable risks. Hence, forex risk management is considered the success factor irrespective of whether you are a professional or a new trader. Foreign exchange risk (also known as fx risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than the domestic currency of the company.

Let’s narrow it down and give you something you can actually use right now. In the end, forex trading is a numbers game , meaning you have to tilt every little factor in your favor as much as you can. The following forex risk management tools can help you complete this task:

Risk management is all about executing positive expectation trades while using leverage responsibly. Don’t have time to read the guide now? Forex risk management, what does it really mean?

Tidak jauh berbeda dengan bisnis lain yang sedang anda jalani, dalam trading pun risiko akan tetap ada. Facebook twitter linkedin by selwyn m. Risk management is the ability to contain your losses so you don’t lose your entire capital.

It’s better to understand this simple fact rather sooner than later and put a lot of efforts into mastering this science. Apa hubungan antara risk dan money management dalam trading forex? It may be easier to follow since we’ll be hitting some pretty technical stuff.

What follows is what we believe to be the best risk management strategy for anyone embarking on learning to trade forex. Money or risk management in forex trading is the term given to describe the various aspects of managing your risk and reward on every trade you make. Risk management dalam trading forex sangat di perlukan jika mau sukses dalam trading tersebut hotline :

But it’s also a broad topic. Changes in the relative value of the two currencies can affect your profit (or loss). If you don’t fully understand the implications of money management as well as how to actually implement money management techniques, you have a very slim chance of becoming a consistently.

The myts forex trading guide. What is risk management in forex trading? You may want to watch the video just for the visual aspect of it alone.

Fortunately, there is a solution. Risiko adalah faktor penyerta dari setiap bisnis yang akan selalu dihadapi. Risk management for forex is the one element in forex trading that cannot be overlooked.

Foreign exchange risk management why is there no need to worry about y y fx risk? Forex risk management enables you to implement a set of rules and measures to ensure any negative impact of a forex trade is manageable. Forex risk management made easy.

Forex risk management is the single most important thing to master. It’s a technique that applies to anything involving probabilities like poker, blackjack, horse betting, sports betting and etc.

6.What are the Risk Management in Forex Trading and How

6.What are the Risk Management in Forex Trading and How

Forex Risk Management Spreadsheet Spreadsheet Downloa

Forex Risk Management Tools FINANCE FANTASY

Forex Risk Management Tools FINANCE FANTASY

Forex Risk Management Strategies

Forex Risk Management Strategies

Forex Risk Management and Position Sizing (The Complete

Forex Risk Management and Position Sizing (The Complete

Forex Risk Management pdf YouTube

Forex Risk Management pdf YouTube

AndyW Forex Risk Management Formula

AndyW Forex Risk Management Formula

Money Management Rules For Forex Forex Risk Management

Money Management Rules For Forex Forex Risk Management

Forex Risk Management E Book Marketpotentials

Forex Risk Management E Book Marketpotentials

Risk Management Basics Improve Your Risk Management with

forex chart reading at risk management YouTube

forex chart reading at risk management YouTube

Forex Risk Management Spreadsheet Spreadsheet Downloa

Complete Forex Trading Guide For Beginners Trader Option

Complete Forex Trading Guide For Beginners Trader Option

Risks Of Forex Trading FX Risk Management How To

Risks Of Forex Trading FX Risk Management How To

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Forex_Risk_Management_Jul_2020-01-44f4b0616f4547ea8cef266cde06cf01.jpg) Understanding Forex Risk Management

Understanding Forex Risk Management

Learn Forex Risk Management Strategies

Forex Risk Management Spreadsheet Spreadsheet Downloa

Forex Risk management 101 YouTube

Forex Risk management 101 YouTube

Comments

Post a Comment